The Indie Era of Startups

Below is a talk I gave at the Main Street Summit a few weeks back in Columbia, MO. Most of it is pretty self-explanatory, but there are some sections worth unpacking based on my speaker notes.

The goal of the talk was to step through the various eras of my venture investing career to create context for the current moment we find ourselves in as it relates to the startup funding environment.

I entered the world of venture capital in 2001 in the wake of the dot com crash. It was an incredibly turbulent time with most of my time spent triaging existing portfolio companies rather than spending any time on new investments.

When we started OATV in 2005, we entered a new era of startup investing with seed as an emergent stage catalyzed by free software, cheap and hosted hardware, and near-zero distribution costs. This drop in costs enabled founders to do with $500k what it would have taken at least $5M to do. The lower costs led to more experimentation around business types and business models. This was a simpler time, pre-unicorn era, where the discussion was rarely around whether something could be a $10B business instead we’d debate whether the latest thing was a feature, a product, or even a company at all.

It was fun, it was experimental and it largely screeched to a halt during the global financial crisis.

The GFC turned out to be a fairly temporary blip in the startup world. Less than a year of slowdown led to a landslide of investment activity. Policy driven by the GFC created a tidal wave of cheap and available capital for investors in nearly every asset class.

To give a sense for the quantum of capital we’re talking about between the dot com and unicorn era- Pets.com (the poster child for the former) raised $50M privately and another $50M in their IPO. WeWork (the poster child for the latter) raised north of $22B prior to declaring bankruptcy earlier this month.

With the unicorn era ending, we’re setting up for the next startup era…

I pulled the next two slides from Terrence Rohan’s excellent post titled Raise Less, Build More under the subheading “Fois Gras” Venture Capital. The visual of fois gras is expertly applied here. As the amount of capital raised by venture capital firms nearly 8x’d between 2013 and 2022, the number of new startups funded didn’t even double.

As Terrence notes:

The clearest trend in the venture industry over the past decade is VCs offering startups more money.

When you take total VC dollars raised, divided by the number of new companies, you’ll see the average startup today has 5x more VC capital available than its counterpart did in 2013…

The deluge of capital had several knock-on effects.

First, as noted in the slide above, every single stage of funding more than doubled between 2014 and 2022. Rather than fund more ideas or more types of founders, most VCs simply ended up giving more dollars to more of the same founders and ideas they’d always back.

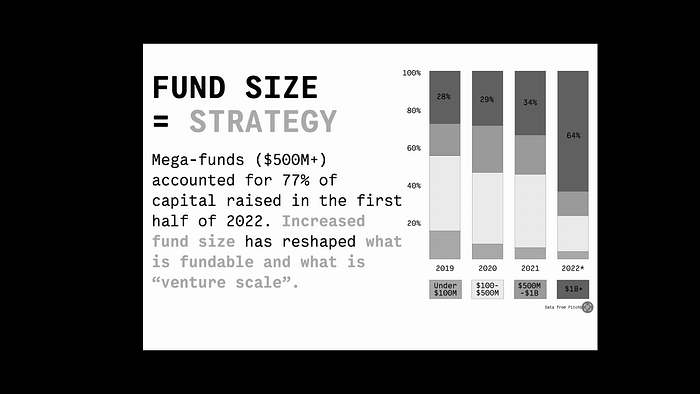

The other knock-on effect was fund sizes expanded and expanded quickly.

With increased fund sizes and an increase of capital to deploy came an increased need for massively outsized outcomes. The math here is pretty simple but the impacts can be less obvious. Great businesses aren’t good enough to drive the kinds of returns needed to generate the kinds of returns mega funds demand. As more capital was consumed, more risk was layered on to push from a great outcome to a mega-fund returning outcome.

Bigger swings often come with bigger burn rates. And as capital was being incinerated at an unprecedented pace, its supply, not unlike during previous eras, screeched to a halt.

Not only did capital raised by startups fall dramatically.

Capital raised by funds also took a major hit. As of Sept 2023 only 327 new funds had been raised, down from the 2021 high of 1,476.

Today, the fuel for startups and the oxygen for funds are being cut significantly. There is less available capital and appetite for burn. As the now weekly headlines highlight, those who aren’t adapting to this new reality are finding themselves in piles of smoldering embers.

If the unicorn era taught us one thing, it’s that more isn’t always the answer. More money doesn’t solve fundamental problems. More people don’t move faster. More features don’t fix product market fit.

There are very real advantages to running lean. Talk to any founder who’s bootstrapped to venture scale and they, like Ryan above, will acknowledge their lack of resources and the constraints they enforced ended up being the superpowers behind their success.

Once you see what some can do with $500k you’ll never not be shocked at how little others can do with $5M (or $50M!).

Being a fiercely independent thinker and builder will prove to be a massive advantage in this new era and we hope to fund and support many of the generational companies that will define it.

Thanks.

@bryce

bryce@indie.vc